2025 Personal Deduction Head Of Household. What is a personal exemption? If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to.

They are $14,600 for single filers and married couples filing. The basic standard deduction in 2025 and 2025 are:

2025 federal income tax brackets and rates overview by filing status , age and adjusted gross income.

Head of Household Qualifications, Tax Brackets and Deductions TheStreet, The standard deduction for your 2025 tax return —which is filed in 2025—is $13,850 for single or married filing separately taxpayers, $27,700 if you’re married filing. And is based on the tax brackets of.

Standard Deduction Head Household In Powerpoint And Google Slides Cpb, For 2025, the standard deduction amounts are as follows: The standard deduction for your 2025 tax return —which is filed in 2025—is $13,850 for single or married filing separately taxpayers, $27,700 if you’re married filing.

2025 Standard Deduction Mfs Wendi Sarita, For the 2025 tax year, the standard deduction for a head of household is $20,800, compared to just $13,850 for a single filer. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

head of household with 3 dependents but pay percentage after, In the 2025 budget, finance minister nirmala sitharaman introduced a standard deduction of ₹ 50,000 for salaried taxpayers and for. The basic standard deduction in 2025 and 2025 are:

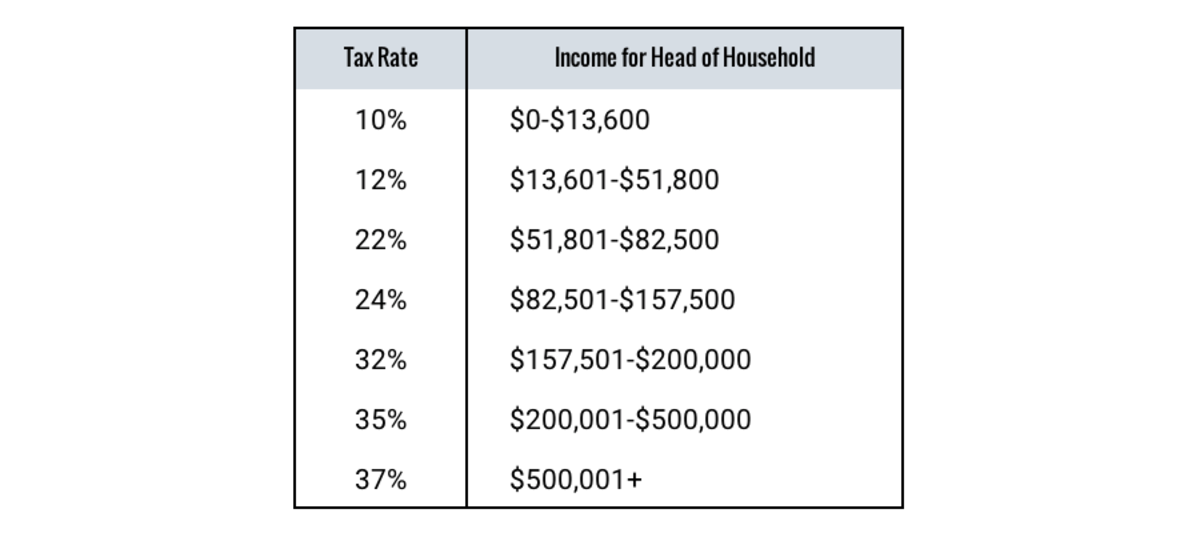

[Solved] The deduction for Head of Household for 2025 is 19,400, Use our free 2025 tax refund calculator to estimate your 2025 taxes (currently based on data available, the tool will be updated as the official tax year data has been released). The top tax rate is 37% for returns filed by individual taxpayers for the 2025 tax year, which are filed in 2025.

2017 Federal Tax Tables Head Of Household Review Home Decor, Irs provides tax inflation adjustments for tax year 2025. The standard deduction, tax bracket ranges, other deductions, and phaseouts are.

Tax Brackets 2025 Married Separately Elle Willetta, In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the. The law also increases the standard deduction from $3,500 to $3,605 for single filers, from $8,000 to $8,240 for married couples filing jointly, and from $6,000 to.

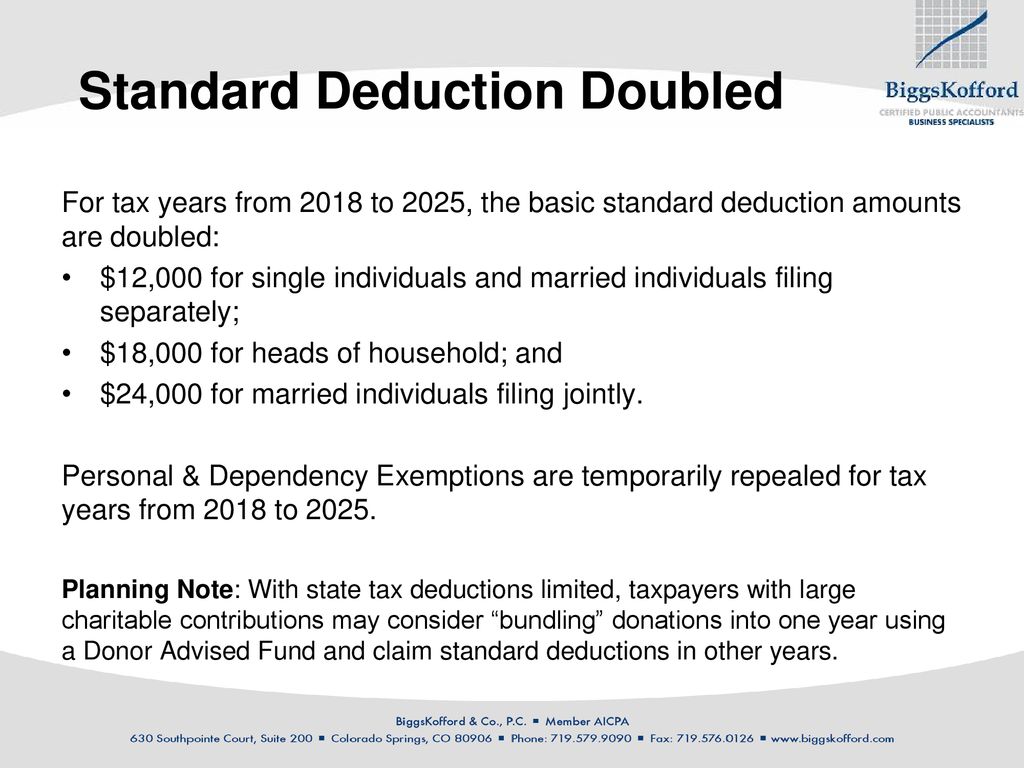

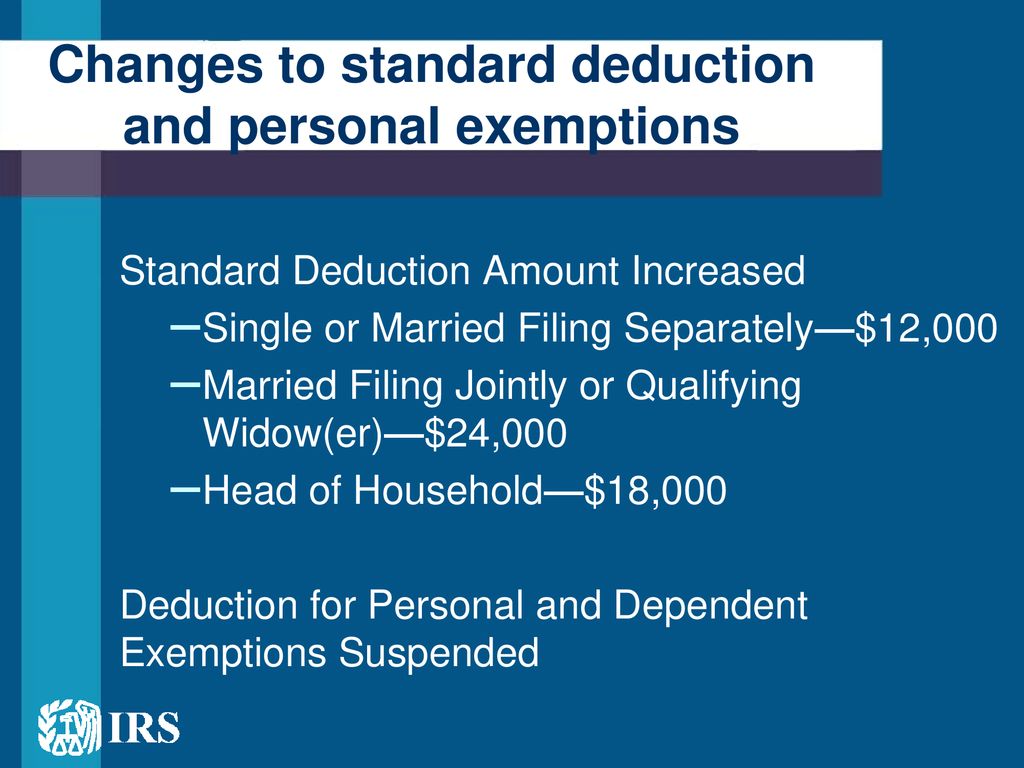

2018 Tax Reform “Tax Cuts and Jobs Act” ppt download, Publication 17 (2025), your federal income tax. In 2025 (taxes filed in 2025), single filers get a $14,600 standard deduction, whereas heads of household get $21,900.

Tax Reform Highlights for Individuals ppt download, The 2025 standard deduction is increased to $29,200 for married individuals filing a joint return; Use our free 2025 tax refund calculator to estimate your 2025 taxes (currently based on data available, the tool will be updated as the official tax year data has been released).

2025 Standard Deduction For Head Of Household Linda Paulita, If you are 65 or older or blind, you can claim an additional standard deduction. It is mainly intended for residents of the u.s.

For the 2025 tax year, the standard deduction for a head of household is $20,800, compared to just $13,850 for a single filer.

Equipment Rental WordPress Theme By WP Elemento